Fossil Fuel Risk Bond Programs - From Vision to Reality

John Talberth and Richard Mietz • February 1, 2024

PROGRAM UPDATE MARCH 2023

Program overview

In 2016 Center for Sustainable Economy proposed a commonsense solution for addressing the market failures associated with fossil fuel infrastructure – fossil fuel risk bond (FFRB) programs. Climate change is one, a market failure of breathtaking proportions. Add to that the market failures associated with fossil fuel infrastructure itself – the vast network of coal mines, oil and gas wells, pipelines, refineries, oil trains, LNG trains and fossil fuel export terminals that cause expensive physical damages to land, air, water and frontline communities.

Air pollution and climate change caused by fossil fuels generate externalized damages of $2.2 – $5.9 trillion per year in the US, and by 2100, the Network for Greening The Financial System predicts a hit in the order of 3 – 10% of GDP each year. Fossil fuel risk bond programs are tools that regulators can use to begin to address these staggering externalized costs. They consist of two primary mechanisms:

- Suites of financial assurance mechanisms such as surety or performance bonds, trust accounts, letters of credit or catastrophic insurance that make fossil fuel infrastructure owners fully responsible for the financial and economic costs associated with explosions, spills, groundwater contamination, abandoned infrastructure and other discrete risks associated with fossil fuel infrastructure, and;

- Fossil fuel risk trust funds capitalized by surcharges on all fossil fuel product transactions in a local economy and used to compensate public agencies, businesses, and individuals for the more generalized risks of fossil fuel infrastructure in their regions such as earthquake swarms or groundwater pollution as well as the costs of climate disasters, climate adaptation and mitigation.

While CSE is working at the national level and in six states with NGOs and elected officials, this update will be focused on the Pacific Northwest, where three separate processes have been kicked off by the organizing work of CSE and its partners.

Project update for Oregon and Washington

King County, WA– nearing the finish line on program implementation

Last week, King County Washington’s Local Services and Land Use Committee unanimously passed the final ‘Phase 3” risk bond ordinance out of committee. It now moves before the full Council for a final vote and is expected to pass without major opposition.

King County is an important test case, since it has now embraced the full policy “trifecta” needed to get the FFRB program fully in place: (a) Phase 1: an initial ordinance (2019) jumpstarting the assessment of risks and costs; (b) Phase 2: an assessment of risks and costs that identifies gaps in the current policy framework and includes recommendations for filling those gaps, and, finally (c) Phase 3: an ordinance requiring all owners of fossil fuel infrastructure not otherwise covered to provide financial assurances to cover the costs of worst-case accidents as well as the costs of decommissioning.

We had to fight for the decommissioning language, but were ultimately successful. We are very excited to have all three steps completed because it gives us policy templates to share with thousands of US counties struggling with the public financial costs of existing and planned fossil fuel infrastructure.

Further reading:

King County FFRB Phase 1 – 2019

King County FFRB Phase 2 risk assessment – 2022

King County FFRB Phase 3 implementation language (draft) - 2023

Oregon– Seismic vulnerability for fossil fuel storage facilities

As a result of organizing around fossil fuel risk bond programs in the City of Portland and Multnomah County, the Oregon legislature passed SB 1567A, which requires owners or operators of bulk oils and liquid fuels terminals located in Columbia, Multnomah or Lane County to conduct and submit to Department of Environmental Quality (DEQ) seismic vulnerability assessments and to pay into a seismic risk mitigation fund to offset public costs associated with the process. While this legislation takes a significant step forward in protecting taxpayers from liabilities associated with a worst-case event at larger fossil fuel facilities in Oregon, much more needs to be done to ensure that whatever seismic mitigation measures are identified are actually implemented and that if facilities are abandoned, funds have been set aside for clean-up and decommissioning.

The DEQ is currently engaged in a rule making process, is developing assessment and mitigation criteria and will also be designing an implementation program. DEQ intends to formally propose these new rules for public comment by the end of May 2023, and hopes to have the Environmental Quality Commission review and adopt these rules at its regular meeting in the Fall of 2023. The DEQ also intends to complete facility assessments by June 1, 2024, as required under the legislation. In the meantime, DEQ established a rules advisory committee to provide input and suggestions during the development of the new rules. The purpose of the committee was to advise DEQ on the development of the rules and to consider the fiscal and equity impacts. The committee held its last regularly scheduled meeting last month.

Further reading:

CSE memorandum – SB 1567A status 2-9-23

CEI Hub economic risk assessment

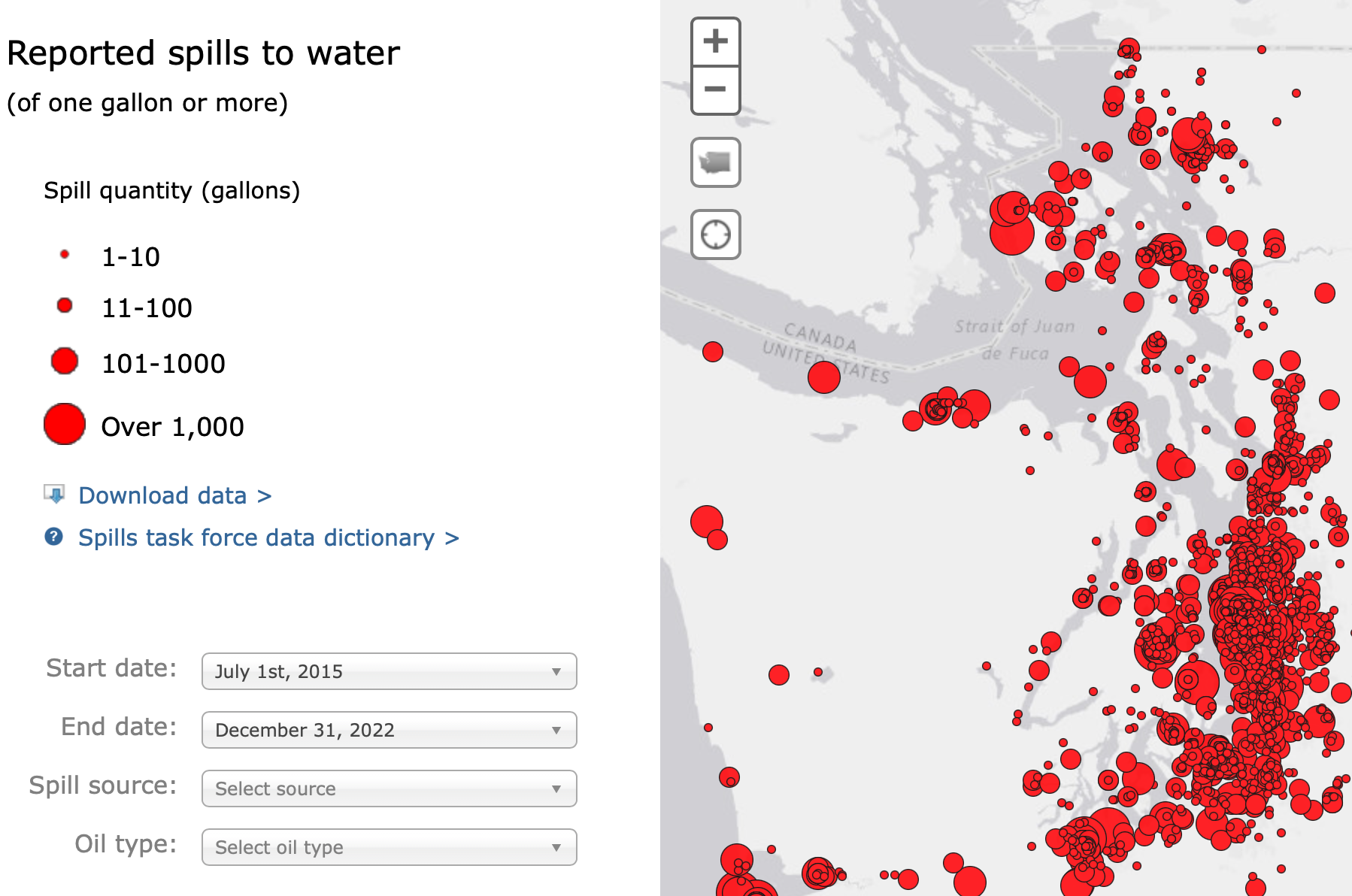

Washington– new financial assurance rules for oil vessels and onshore facilities

Led by Rep. Mia Gregerson (D-33) the Washington legislature passed HB 1691 this time last year as a first step towards implementing fossil fuel risk bond programs at the state level. HB 1691 requires the owners or operators of any covered oil vessel or oil facility to obtain a "certificate of financial responsibility” from the Department of Ecology (DOE) that guarantees such owners fully cover the costs of a worst-case spill. The law is a bit complex, and DOE is now charged with initiating a host of new rules to comply. These include:

1) DOE must adopt rules governing the effective date for owners and operators of covered vessels or facilities to obtain the required certificates of financial responsibility. RCW 88.40.020(5).

2) DOE may adopt rules that provide a self-insurance option provided that such rules must require the applicant to thoroughly demonstrate the security of the applicant’s financial position. RCW 88.40.030(2).

3) DOE must adopt rules governing the suspension, revocation, and re-issuance of certificates of financial responsibility in light of potential liabilities incurred by a covered entity after an oil spill or other incident which may affect the entity’s ability to maintain sufficient financial resources to meet the state’s financial responsibility requirements. RCW 88.40.040(3).

4) DOE is required to adopt a rule to evaluate whether an applicant for a financial responsibility certificate for an onshore or offshore facility has demonstrated an ability to compensate the state and other governmental entities for damages that might occur during a worst case oil spill. RCW 88.40.025.

5) DOE may engage in rule making to update the hazardous substances currently covered by the state’s existing financial responsibility requirements to maintain consistence with CERCLA. RCW 88.40.020(7).

CSE has been briefed on the process, and it appears that the initial round of rulemaking will be announced this April. As per Washington law, the rules will be accompanied by a benefit-cost analysis, which CSE will be closely tracking. The target date for rulemaking on the ground is about 18 months from now (September 2024).

Further reading: